Use Case: VAT options for product in sale row

Use Case

The VAT set on the product is automatically applied on the product in the sale, but it can be changed on a product-by-product basis on the sale row with parameters.

Tables can't be imported directly. Please insert an image of your table which can be found here.

isnetpriceWhen set true, the price of the row (total + vat) is a net price defined in the integrated system. This price will not change according to the valid product price known in Tehden.

totalvatvatpercentvatstatus_idVAT options for a customer

Used Endpoints

saleorder/createSaleOrderAndRows saleorder/createSaleRowExample

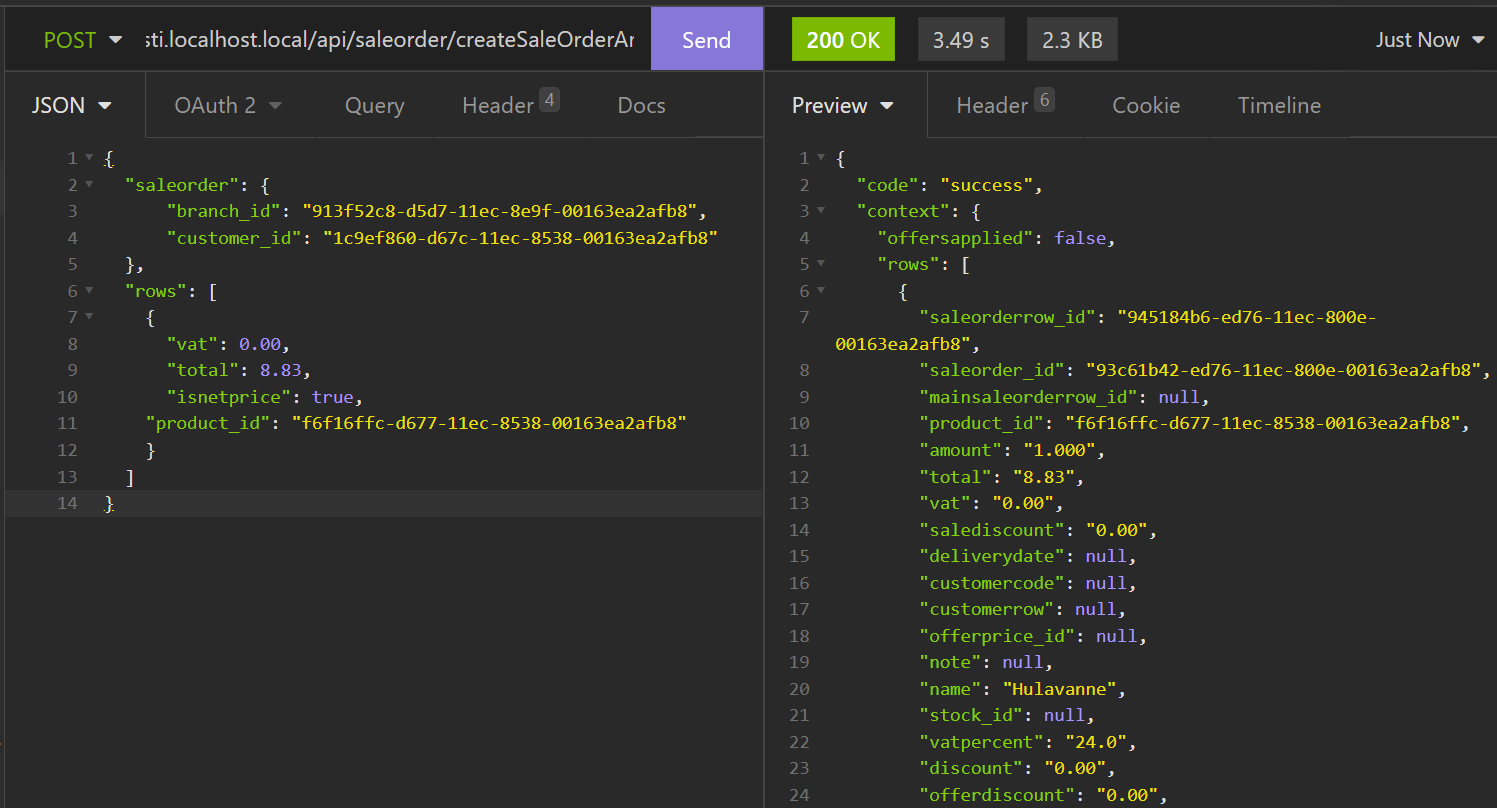

Payload when calling saleorder/createSaleOrderAndRows. Vat and total as parameters and isnetprice used, meaning the price will not change according to the valid product price known in Tehden.

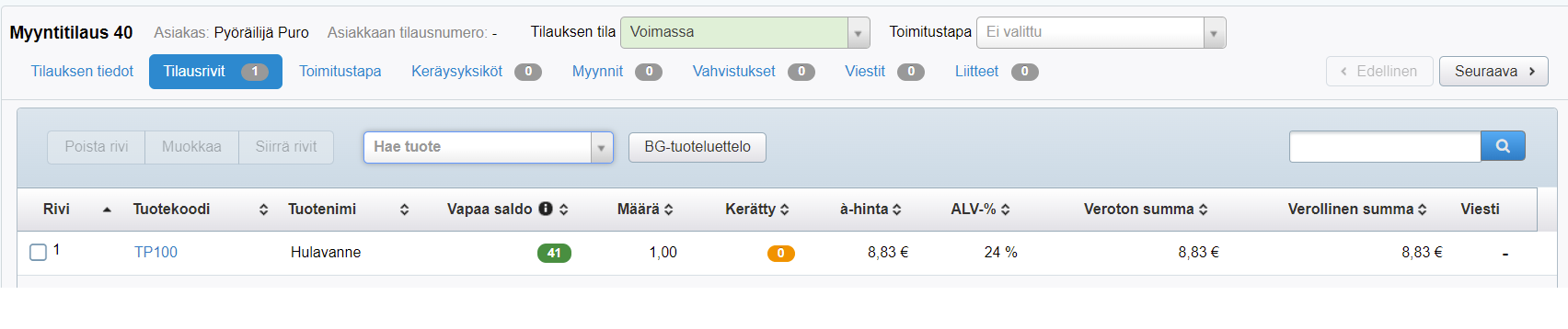

The sale row in Tehden by the payload above. The VAT percent is visible as the product's VAT percent but it is not added to the tax free price.

Screenshots from the user interface are in Finnish because a large part of our customers use Tehden in Finnish.