Use Case: VAT options for a customer

Use Case

The customer VAT status can be set with parameter vatstatus_id. Customer's vatstatus_id affects the default VAT handling for the customer. Most will require the customer to be a company. The options for vatstatus_id are shown below.

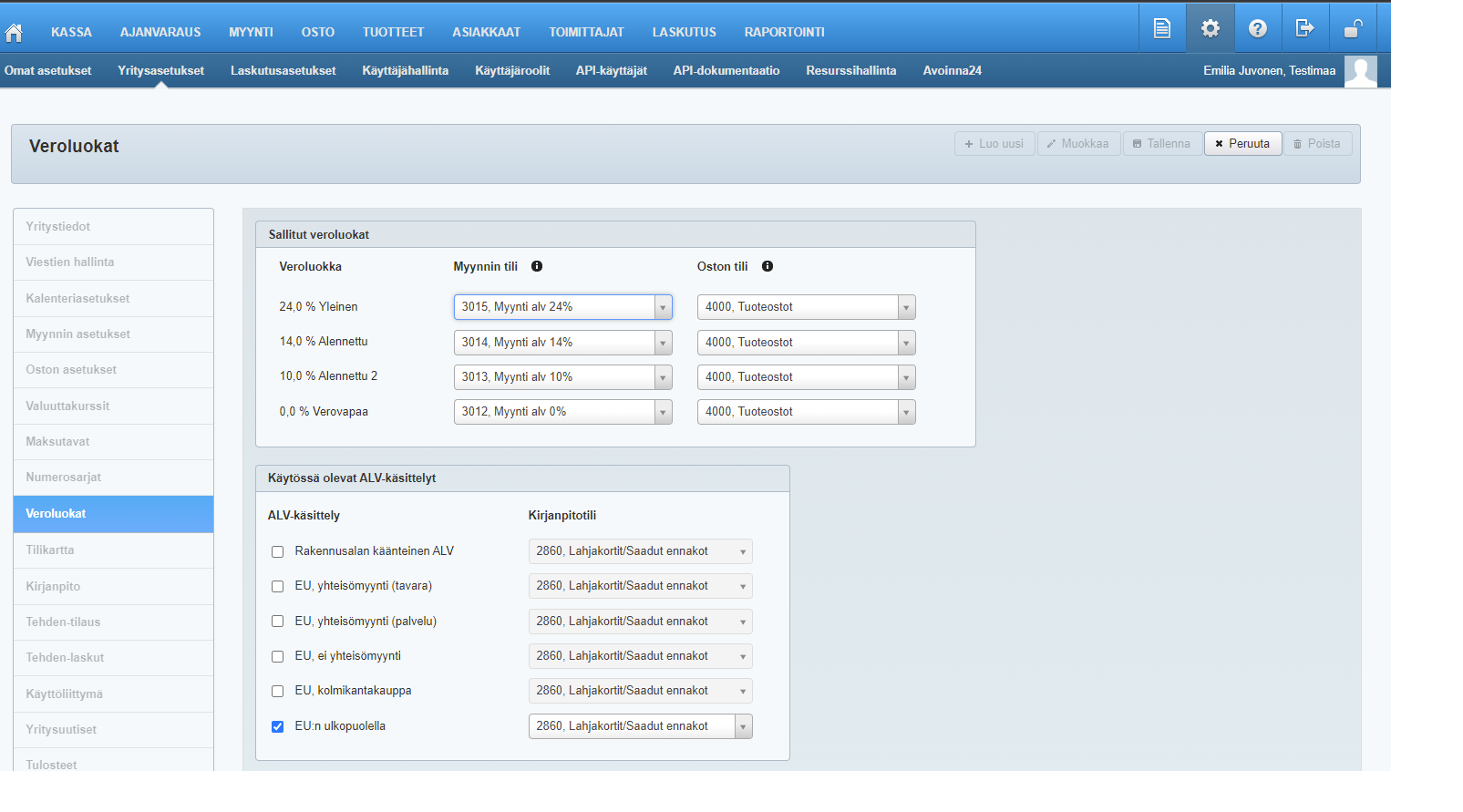

Tables can't be imported directly. Please insert an image of your table which can be found here.

Requirements

The vatstatus_id can be set to the customer only if the VAT treatment to be set is enabled in Tehden. It can be enabled in Tehden UI Settings -> Company Settings -> Tax categories -> Modify.

Used Endpoints

company_customer/updateTehdenCustomer

Screenshots from the user interface are in Finnish because a large part of our customers use Tehden in Finnish.